Houseware Emerges from Stealth Mode to Revolutionize Revenue Optimization for SaaS Companies Using Data-Driven Insights

As the SaaS market continues to grow at an unprecedented rate, with a projected increase of 19.7% over the next six years, startups in this crowded space are seeking innovative ways to improve product development, identify hidden market opportunities, and complete work with fewer false steps. One startup that aims to help these companies achieve their goals is Houseware, which has emerged from stealth mode with $2.1 million in funding led by Tanglin Ventures Partners.

The Problem: Data Teams vs. Revenue Teams

Houseware’s co-founder and CEO, Divyansh Saini, identified a disconnect between how data teams talk about metrics and what revenue teams demand out of those numbers while working at data analytics company Atlan. Traditionally, the data team sits far away from the problems and is treated as a service function, spending weeks modeling data for particular use cases.

The Solution: Houseware

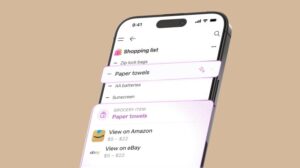

Houseware was founded in 2021 by Shubhankar Srivastava and Saini with a simple question: "What would it take to flip the value of the data warehouse from data and engineering teams to the revenue function inside organizations?" The company offers an easy-to-use, no-code interface for operations and revenue teams to bring SaaS companies closer to using data more efficiently in their day-to-day use cases.

How Houseware Works

Houseware allows users, such as those in the customer success team, to model insights on the go on product pricing, which can then be used by finance teams as they consider how to alter those prices. This is significant because while products like Snowflake have made it easy to work with large volumes of data at scale in the last half a decade, most companies’ revenue teams are still untouched by that paradigm shift.

Target Customers and Key Metrics

Houseware’s target customers are SaaS enterprises with more than 1,000 employees. The company tracks the percentage of employees activated as a key metric across companies using its platform. According to Saini, up to 30% of employees can be activated on the Houseware platform.

Competitive Landscape

Houseware competes in a crowded market, but its focus on no-code interface and easy-to-use features sets it apart from other players. The company’s ability to bring data teams and revenue teams closer together also provides a unique value proposition.

Funding and Future Plans

Houseware has raised $2.1 million in funding led by Tanglin Ventures Partners, which will be used to scale the business and expand its product offerings. Saini plans to use the funds to build out the company’s sales and marketing teams, as well as develop new features for the platform.

Conclusion

Houseware’s emergence from stealth mode marks an exciting development in the SaaS market. With its focus on no-code interface and easy-to-use features, Houseware is poised to help SaaS companies make better decisions faster. As the company continues to scale and expand its product offerings, it will be interesting to see how it addresses the challenges of the competitive landscape.

Related News

- Clari revenue forecasting platform snags $150M investment and triples valuation to $1.6B

- DataJoy raises $6M seed to help SaaS companies track key business metrics

- Kate Park, a reporter at TechCrunch, covers technology, startups, and venture capital in Asia.

Stay Up-to-Date with the Latest News

Subscribe to TechCrunch’s newsletters for the industry’s biggest tech news. Follow us on social media platforms for real-time updates and analysis of the latest trends and developments.

Newsletters

- TechCrunch Daily News: Get the best of TechCrunch’s coverage every weekday and Sunday.

- TechCrunch AI: Stay up-to-date with the latest news in AI from TechCrunch’s experts.

- Startups Weekly: Get the core of TechCrunch’s coverage delivered weekly.

Social Media

Follow us on social media platforms for real-time updates and analysis of the latest trends and developments:

Related Stories

- Failed fintech startup Bench racked up over $65 million in debt, documents reveal.

- Mark Cuban is ready to fund a TikTok alternative built on Bluesky’s AT Protocol.

About the Author

Kate Park is a reporter at TechCrunch, with a focus on technology, startups, and venture capital in Asia. She previously was a financial journalist at Mergermarket covering M&A, private equity, and venture capital.