Germany requires a stable government to address shifts in US policy and promote growth.

The collapse of Germany’s coalition government marks a pivotal moment in the country’s political landscape. Amidst the uncertainty brought about by the US election results, Chancellor Olaf Scholz has announced plans to hold new elections by the end of March. However, this timeline may be expedited depending on the timing of a parliamentary confidence vote. The timing of these developments is particularly critical given the broader context of Germany’s economic trajectory.

The Broader Context: A Trump Presidency and Its Impact

The incoming US administration, with its potential to replicate some aspects of the second Trump presidency, poses significant challenges for Germany. A key point of concern is the likely impact of increased military spending by the US on German budgets. While Germany already operates above the NATO target level of 2% of GDP—supported in part by a €100 billion special fund established in 2022—the country is under pressure to accommodate rising defense expenditures.

Economic Forecasts and Structural Weaknesses

Germany’s economic growth has been marked by persistent structural weaknesses. While the country avoided deeper stagnation over the past two years, signs of deceleration are present. Current estimates suggest that GDP growth will be weak in 2024, with projections indicating a stagnation rate of -0.1%. This forecast is subject to considerable uncertainty due to potential trade disruptions, declines in business confidence, and delays in investments. Additionally, the next government’s fiscal stance may exacerbate these challenges.

The US Dollar and Trade Relations

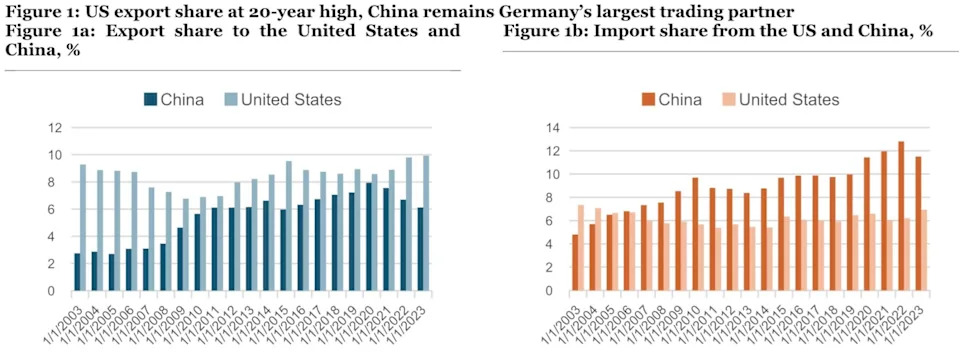

The ongoing trade relationship between Germany and the United States remains strained, with significant implications for both economies. A portion of German exports destined for the US could be impacted by higher import tariffs imposed by the incoming administration. In 2023, nearly 10% of German goods were headed to the US—a figure not seen in over two decades. At the same time, China’s increasing dominance in global markets has reduced Germany’s reliance on its exports to this major Asian country.

The Role of China in Global Trade

China continues to play a central role in Germany’s trade landscape, with imports from this country accounting for 11.5% of total imports in 2023. This high dependency underscores the vulnerability of German supply chains to disruptions. Rising global protectionism and the potential for a US-China trade war further complicate these risks, particularly as both nations navigate their respective political and economic landscapes.

Fiscal and Defense Policy Challenges

Germany faces significant challenges on both the fiscal and defense fronts. The incoming administration is expected to demand increased military spending from the German government, even as Germany already operates above the NATO target level of 2% of GDP. This pressure is compounded by Germany’s existing debt ratio of around 60%, a figure set to decline further in coming years due to constrained fiscal space.

Parliaments and Governance

The collapse of the coalition government has led to increased scrutiny on Germany’s parliamentary process. The incoming administration’s plans for new elections are part of a broader effort to address governance challenges while ensuring political stability. This transition period is expected to be volatile, with potential shifts in power and influence shaping the direction of German policy over the coming months.

Conclusion: A Complex Landscape Ahead

In summary, Germany faces a complex set of challenges as it navigates the aftermath of its coalition government collapse. The incoming administration’s plans for increased defense spending, coupled with ongoing trade tensions with the US and uncertainties surrounding China’s global role, create a challenging environment for policymakers. Additionally, structural weaknesses in the economy remain a concern, further compounding the risks ahead.